Part 1

“You sure this is the final version?” I asked, squinting at the Q4 ledger Brandon Walsh had just slapped on my desk like it owed him money. The numbers danced around like they were trying to escape, and line 47C showed an asset reallocation from restricted capital reserves to discretionary operations. No date, no memo, no signature. That line hadn’t existed when I reviewed the preliminary draft two weeks ago.

I’m Bill Patterson, fifty‑two, and I’ve been doing financial compliance for twenty‑five years. The last twelve of those have been right here at Hartwell Financial Services, watching this company grow from a mid‑size regional firm to a serious player in commercial lending across the United States. I know what laundered funds look like when they’re dressed up in a spreadsheet.

Brandon leaned over my cubicle wall, smirking like he’d just discovered fire. At thirty‑four, he was our new VP of Finance, brought in six months ago from a fintech startup that burned through investor money faster than a casino.

“It’s budget season, Bill,” he said, voice dripping with that special condescension reserved for people who think gray hair equals obsolescence. “We needed your files for formatting. You know, presentation stuff.”

Formatting. Presentation. I’ve been buried in SOX compliance since Enron made headlines. I built the financial controls at this company from the ground up. I know what a reclassified fund looks like when someone’s trying to hide $3.2 million in regulatory violations behind fancy slide graphics.

That moment in November was the spark. Not a full explosion yet, but the unmistakable stench of electrical fire behind the walls. You don’t see the flames, but you know they’re coming. I didn’t respond to his smirk. I just took the printout, walked back to my corner of the Compliance Department, and opened my laptop with the same reverence most people reserve for their morning coffee ritual.

My official title was Senior Financial Compliance Officer. What I really did was catch financial mistakes before they landed us in federal court or cost us our banking licenses in the U.S. But lately, things had been shifting like tectonic plates. The vendor compliance dashboard had mysteriously locked me out that Thursday in November. A shared drive folder I’d maintained since 2018—containing every audit trail and regulatory filing—had been archived for “system optimization.” Three internal audit requests I’d submitted in early November had been rerouted without my name attached, straight to Brandon’s new assistant, Ashley Morrison.

Ashley was twenty‑six, fresh MBA from an online program, who once asked during a staff meeting if depreciation meant the building was getting sadder over time. Yet somehow, she was now handling budget consolidation for our biggest acquisition deal in company history. I sent a polite email to Legal. Radio silence. I sent a follow‑up noting some irregularities in the vendor payment matrix. “Please advise on compliance protocols.” The usual neutral corporate speak designed not to ruffle feathers. Still nothing. HR gave me the classic runaround: Had I tried discussing this directly with Brandon?

What they didn’t know—what Brandon definitely didn’t know—was that I built this entire system. Every compliance protocol, every audit trail, every safeguard they now pretended didn’t matter. I wrote the vendor‑management procedures they were casually ignoring. I designed the risk assessment matrix Brandon was now trying to game.

And back in 2019, when we renewed our acquisition protection contract with Meridian Capital Partners—our largest institutional investor headquartered in the U.S.—I helped draft a legal clause. Clause 14D. Asset Seizure and Compliance Enforcement. At the time, our lead counsel called it a failsafe provision I’d sketched out after watching too many companies get destroyed by acquisition fraud. The language was so detailed it required three footnotes just to explain the enforcement mechanism. I thought it was clever but probably unnecessary—belt and suspenders. But Meridian’s legal team had signed off on every word. Every contract renewal since had carried it forward, buried deep in PDF appendices and forgotten SharePoint archives.

The clause was simple in concept, devastating in execution: in the event of unreported or misclassified restricted capital exceeding $2 million during any acquisition‑related due diligence or formal quarterly audit, the institutional partner may invoke immediate asset review and temporary operational control pending regulatory investigation. Translation: if you misrepresent restricted funds over $2 million during a deal, your business partner gets to freeze your assets and call in federal auditors.

Now, with Q4 projections artificially inflated and Brandon preparing to present fictional numbers to Meridian’s acquisition team, that clause wasn’t theoretical anymore. It was a loaded mechanism with Brandon’s fingerprints all over the trigger.

By early December, I’d started my own quiet investigation. Every discrepancy was logged and cross‑referenced. Every deleted email was captured through my private BCC system—a little safeguard I’d built into my Outlook years ago. Every suspicious spreadsheet edit was screen‑captured with timestamps and digital signatures. I wasn’t being paranoid. I was being thorough. Twenty‑five years in this business teaches you that the details matter, and Brandon was practically sending me engraved invitations.

The real problem wasn’t just the $3.2 million in misclassified restricted capital that Ashley had magically transformed into discretionary surplus for Q1 strategic initiatives. The problem was Brandon’s timeline. He was rushing to present these inflated numbers to Meridian’s partners before year‑end, probably hoping to secure a bigger acquisition premium and boost his own bonus. He had no idea that those same numbers would automatically trigger the compliance review protocols I’d embedded in our institutional partnership agreement five years ago.

I went home that December night and pulled out a secure thumb drive I kept in my home safe, next to insurance papers and my wife’s jewelry. Inside: contract originals, compliance documentation, system architecture diagrams, and one file labeled MERIDIAN_CLAUSE_14D_FINAL_EXECUTED.pdf. They thought they were playing checkers. I’d been setting up chess moves for half a decade. The pieces were all in position. Brandon just didn’t realize he was about to put himself in a checkmate of his own making.

Part 2

My login failed at 8:07 a.m. on December 15th. Not a system crash or network timeout—just a blunt corporate message blinking with no warmth: Access revoked. Contact your administrator for assistance. I sat there with my coffee getting cold, staring at the screen that had been my workspace for over a decade. Two critical folders were gone from my dashboard: the Vendor Reconciliation Archives and the Q3–Q4 Rollover Compliance Files. Both carried my digital signature and contained documentation going back to 2018. Now they were locked behind Brandon’s administrative control.

The irony wasn’t lost on me. I’d designed this security system myself back in 2015, implementing role‑based access controls that could isolate compromised accounts within minutes. I just never imagined I’d be on the receiving end of my own safeguards.

I walked over to Brandon’s corner office—the one with glass walls because he believed in “transparent leadership.” He was leaning back in his ergonomic chair, watching a business influencer explain cryptocurrency trading strategies. Ashley sat across from him, nodding like she was absorbing ancient wisdom instead of very speculative tips.

I knocked once on the glass door. “Morning, Brandon. Seems I’ve been locked out of the compliance archives.”

He glanced up without pausing the video. “Yeah, we’re streamlining access protocols for the acquisition review. Ashley’s consolidating all the financial documentation into a single presentation package.” He gestured vaguely toward his assistant. “Makes the due diligence process more efficient.”

Efficient like removing safety rails from a cliff. I kept my expression neutral. “I assume you’ve maintained the audit trail requirements. Section 404 mandates we preserve documentation chains for all material transactions.”

Brandon’s eyes glazed over like I’d started reciting tax code in Ancient Greek. “Look, Bill, don’t overthink this. It’s just housekeeping before the big presentation. Ashley understands the compliance stuff.”

Ashley beamed at me with the confidence of someone who hadn’t yet wrestled with the Code of Federal Regulations. “We’ve got everything under control, Mr. Patterson. I’ve been working with modern cloud‑based solutions that are way more streamlined than those old file systems.”

“Modern cloud‑based solutions.” She was talking about moving regulated financial data to consumer‑grade cloud storage without proper encryption or access controls. I felt my left eye twitch—a nervous habit I’d developed during the 2008 financial crisis when I’d watched supposedly smart people make catastrophically unwise decisions.

“What about the restricted capital classifications?” I asked, keeping my voice level. “Those require specific documentation under our Meridian partnership agreement.”

Brandon waved his hand like he was swatting a fly. “Already handled. We’ve reclassified some of the more restrictive categories to give us better flexibility. Nothing major, just updating the language to reflect current market conditions.”

Nothing major. He’d just admitted to violations that could implicate federal banking rules and breach of contract, apparently without understanding the legal implications. The restricted capital accounts contained $3.2 million in funds specifically earmarked for regulatory compliance reserves. Moving those funds to discretionary categories wasn’t “updating language”—it was misrepresentation.

I nodded and walked away before I said something that would end my career prematurely. Back at my cubicle, I opened my secondary monitoring system—a read‑only access portal I’d built into the network architecture years ago for system maintenance. It wasn’t technically part of my regular login credentials, so Brandon’s IT lockdown hadn’t touched it. Through this backdoor, I could still view transaction logs, audit trails, and system access patterns.

What I found made my coffee taste like battery acid. Between December 10th and 14th, Ashley had systematically reclassified $3.2 million from restricted compliance reserves to operational surplus “available for strategic deployment.” Each transaction carried Brandon’s digital approval signature. No compliance review, no legal consultation, no risk assessment documentation. Worse, she’d scheduled these funds for presentation to Meridian’s acquisition team as evidence of the company’s improved liquidity position and strategic flexibility. The presentation was set for January 8th—just three weeks away.

I traced the edit history. Ashley had used templates she’d downloaded from a finance blog, completely ignoring the regulatory frameworks I’d spent years implementing. She’d even deleted the mandatory compliance footnotes, probably because they contained too much technical jargon. This wasn’t just sloppy bookkeeping. It was a pattern of misrepresentation, and they were about to present it to our biggest institutional partner during the most important business negotiation in company history.

I pulled up the original Meridian partnership contract and found Clause 14D buried in Appendix 7, Section 12, Subsection 4. The language was dense but unambiguous: any misrepresentation of restricted capital exceeding $2 million during acquisition due diligence would trigger automatic asset review and potential seizure. The threshold was $2 million. Brandon and Ashley had just crossed it by $1.2 million, with three weeks’ worth of documentation proving intent and systematic planning.

I opened a new document and began compiling evidence. Screen captures of the original classifications versus Ashley’s revisions. Timestamps showing the rapid sequence of unauthorized changes. Email threads where Brandon explicitly approved moving restricted funds without legal review. Every piece of evidence was saved in three locations: my secure home drive, an encrypted cloud backup, and a physical USB drive hidden in my desk drawer behind expired antacid tablets and forgotten birthday cards.

Then I did something I’d never done in twenty‑five years of compliance work: I sent a carefully worded email to our external auditing firm, flagging potential inconsistencies in Q4 restricted capital reporting that may require preliminary review. I didn’t mention Clause 14D. I didn’t need to. The auditors would find the violations themselves, and when they did, the enforcement mechanism would activate automatically.

Brandon thought he was consolidating power. In reality, he was creating a situation that would bring objective oversight straight to our door while I quietly measured the distance to the trigger.

Part 3

The office holiday party on December 20th was where Brandon made his biggest mistake. Not the financial misrepresentation—that was a mix of ambition and inexperience. His real error was making it personal.

I was standing near the coffee station, nursing a cup of the caterer’s surprisingly decent brew, when I heard Brandon’s voice carrying across the break room. He was holding court near the catered sandwich table, gesturing with a plastic cup of inexpensive wine like he was delivering a talk.

“The problem with legacy employees,” he said, voice warm with holiday cheer and a little too much self‑confidence, “is they get stuck in old paradigms. Take Bill Patterson, for example. Guy’s been here since the Stone Age, still thinks we need to follow every bureaucratic checkbox from the 1990s.”

Laughter rippled through the small crowd. Ashley giggled. A few younger employees nodded along, probably hoping Brandon would remember their faces come promotion time. “I mean, the man literally prints out emails,” Brandon continued, warming to his theme. “Prints them out! Like we’re running some kind of museum instead of a modern financial services firm. No wonder our compliance costs are high.”

I took another sip of coffee and stayed exactly where I was, letting them think I couldn’t hear. Sometimes the best intelligence comes from people who forget you’re in the room.

“Honestly,” Brandon said, lowering his voice to a stage whisper that carried perfectly across the tile floor, “I’m just waiting for him to retire so we can finally bring this company into the twenty‑first century. Ashley’s already shown me how we can automate half his job with basic spreadsheet macros.”

That’s when I decided Brandon Walsh needed a lesson about the difference between experience and obsolescence. I finished my coffee, threw away the cup, and walked past their little circle without making eye contact. But I made sure to speak just loud enough for the group to hear: “Merry Christmas, everyone. Enjoy the holidays. January’s going to be… educational.”

Brandon looked confused. Ashley raised an eyebrow. The other employees glanced between us like they’d just witnessed something significant but couldn’t quite figure out what.

I left the party early and spent Christmas week at home, ostensibly on vacation but actually preparing for a comprehensive review. My wife, Sandra, thought I was finally learning to relax after years of bringing work stress home. In reality, I was building the most exhaustive compliance audit documentation package of my career. Every transaction Ashley had “modernized” was cross‑referenced against federal banking regulations in the United States. Every fund reclassification was mapped to specific requirements under our Meridian partnership agreement. Every email thread was preserved with full metadata, including the digital signatures proving Brandon’s direct authorization of each problematic move.

The beauty of Clause 14D wasn’t just its automatic enforcement mechanism—it was the documentation requirements. The clause required clear and convincing evidence of systematic misrepresentation before asset measures could proceed. Brandon and Ashley had handed me that evidence, complete with timestamps and approval chains.

On January 2nd, I returned to the office to find a meeting invitation in my inbox: Q4 Financial Review and Strategic Planning Session—All Hands Required. The meeting was scheduled for January 8th at 9:00 a.m., with Meridian Capital Partners joining via video conference for the second half. I also found a printed memo on my desk—apparently Brandon’s idea of modern communication when he wanted to be emphatic. The memo informed me that my compliance oversight responsibilities were being “streamlined and redistributed to better align with the company’s agile operational framework.”

In plain English: I was being pushed out of my own department. The memo was signed by Brandon and countersigned by our CFO, Margaret Walsh, who’d apparently decided that political survival meant backing the VP’s play regardless of consequences. It also included a new org chart showing Ashley as Director of Financial Operations and me relegated to Senior Advisor—Legacy Systems.

Legacy Systems. As if U.S. federal banking regulations were some kind of outdated software that could be patched out of existence. I forwarded the memo to my personal email, then added it to my evidence file. By this point, I had enough documentation to end Brandon’s tenure decisively. But I wanted him to confirm his position with his own words in front of witnesses.

The morning of January 8th arrived gray and cold, with the kind of persistent drizzle that makes everything look like a film noir. I got to the office at 7:30 a.m.—early even by my standards—and spent ninety minutes making final preparations. I printed hard copies of every piece of evidence, organized chronologically in three identical binders. One went into my desk drawer, one into my briefcase, and one into my car’s glove compartment. I’d learned long ago that digital evidence could disappear with a few keystrokes, but paper trails were harder to erase.

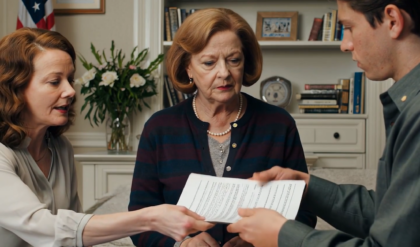

At 8:45 a.m., I walked into the main conference room to find Brandon already there, setting up his laptop with the confidence of a man who’d never experienced real consequences for his actions. Ashley sat beside him, shuffling through printed slide decks with the focused intensity of someone trying to look professional. The Meridian team would be connecting at 10:00 a.m., giving Brandon an hour to present his financial picture to our own board first. He’d structured the meeting to build internal consensus, then present a united front to our institutional partners. He had no idea he was about to trigger the most sophisticated compliance enforcement mechanism in our industry.

I took my seat at the far end of the table, opened my laptop, and waited for the show to begin. The preparation was complete. Brandon just needed to step into the spotlight.

Part 4

The boardroom filled slowly. Margaret Walsh arrived first, followed by our three external board members, then the department heads who’d been summoned to witness Brandon’s moment. Everyone took their seats around the polished conference table while Brandon adjusted his laptop, projecting confidence like aftershave.

At exactly 9:00 a.m., he stood and clicked to his first slide: “Q4 Performance Review and Strategic Outlook.” The presentation was slick, professional, and built on a foundation of fiction.

“As you can see,” Brandon said, gesturing toward a colorful bar chart, “we’ve successfully optimized our capital allocation to create $3.2 million in operational surplus for Q1 strategic initiatives.” He clicked to the next slide. “This enhanced liquidity position demonstrates our readiness for accelerated growth under Meridian’s expanded partnership framework.”

I watched the board members nod. Margaret smiled like she’d personally engineered this financial miracle. Ashley took notes with the focused intensity of someone documenting her own career advancement. Nobody questioned the numbers. Nobody asked about the source of this sudden windfall. Nobody wondered why restricted compliance reserves had transformed into discretionary capital.

Brandon continued for forty‑five minutes, painting a picture of unprecedented flexibility and strategic opportunity. Every slide reinforced the same fundamental claim: that Hartwell Financial had discovered millions in surplus capital without corresponding revenue increases or cost reductions.

At 9:52 a.m., eight minutes before the Meridian team was scheduled to join the call, I finally spoke. “Brandon,” I said quietly, “before we bring in our institutional partners, shouldn’t we review the compliance documentation for these asset reclassifications?”

The room went silent. Brandon’s smile faltered for just a moment before snapping back into place. “I’m sorry, Bill, but we’ve already covered the technical details in our internal review process. I don’t think we need to bog down the board with procedural minutiae.”

“Section 404 of Sarbanes–Oxley requires documentation of all material changes to restricted capital accounts,” I continued, my voice calm and professional. “Meridian’s partnership agreement specifically references these requirements in Clause 14D.”

Brandon’s face reddened slightly. “Look, Bill, I appreciate your attention to detail, but—”

“Ashley,” I interrupted, turning to his assistant, “can you walk us through the authorization process for moving $3.2 million from restricted compliance reserves to operational accounts?”

Ashley blinked. “Well, we… I mean, Brandon approved all the necessary… The documentation is—”

“Where’s the legal review?” I pressed gently. “The risk assessment? The compliance impact analysis?”

“We don’t need—” Brandon started.

“Actually, we do.” I opened my laptop and projected my own presentation onto the secondary screen. “Because according to our Meridian Capital partnership agreement—Section 7, Appendix 14, Clause D—any misrepresentation of restricted capital exceeding $2 million during acquisition due diligence triggers automatic asset review and enforcement proceedings.”

The room temperature seemed to drop. Margaret leaned forward, suddenly very interested in compliance details that had been glossed over for months.

“The threshold is $2 million,” I continued, clicking to my next slide. “You’ve reclassified $3.2 million. That’s $1.2 million over the automatic trigger limit.” I clicked again. Screen captures of Ashley’s unauthorized changes filled the projection screen, complete with timestamps and approval signatures. “Here’s the transaction history: December 10th through 14th. Systematic reclassification of federally regulated compliance reserves, approved by Brandon Walsh, without legal review or compliance documentation.”

“Those are just formatting adjustments,” Brandon said. “We haven’t actually moved any—”

“Yes, you have.” Another click. “Here are the actual fund transfers. $3.2 million moved from restricted accounts to discretionary operational budgets. Each transaction carries your digital signature.”

The board members stared at Brandon like they’d just heard a confession. Margaret looked pale.

At exactly 10:00 a.m., the conference‑room phone rang. The Meridian team was ready to join the call.

“Should I answer that?” Margaret asked, her voice unsteady.

I stood up, walked to the phone, and picked up the receiver. “Good morning, this is Bill Patterson, Senior Compliance Officer at Hartwell Financial. Before we begin today’s presentation, I need to formally notify you that we’ve discovered material misrepresentations in our Q4 restricted capital reporting that may trigger enforcement provisions under our partnership agreement.” The silence from the Meridian end was complete. “Specifically, Clause 14D appears to have been activated by unauthorized asset reclassifications exceeding the $2 million threshold. I’m transmitting the documentation to your legal team now.”

I hung up and turned back to the room. Brandon stared at me like I’d upended the agenda. Ashley looked close to tears. The board members were checking their phones as Meridian’s legal notifications started arriving.

“Bill,” Margaret said slowly, “what exactly does Clause 14D authorize?”

“Immediate asset measures pending federal compliance review,” I replied calmly. “Meridian can assume temporary operational control of any accounts related to the breach until investigators determine the extent of the violations.”

“You can’t do this,” Brandon said. “This is—this is sabotage.”

“No,” I said, closing my laptop and gathering my papers. “This is compliance. It’s what I’ve been trying to explain for two months.” I walked toward the door, then paused. “Oh, and Brandon? Those ‘legacy systems’ you’ve been mocking? They were designed specifically to prevent exactly this kind of situation. Next time, read the manual before you try to rewrite the machine.”

By noon, Meridian’s forensic accounting team had placed a freeze on $8.7 million in company assets pending investigation. By close of business, Brandon and Ashley were escorted out by security while the review proceeded. By the end of the week, I had a new title: Executive Vice President of Compliance and Risk Management, reporting directly to the board, with a forty‑percent salary increase.

Sometimes the best accountability isn’t dramatic. It’s thorough, professional, and perfectly timed. I kept Brandon’s memo about “Legacy Systems” framed on my office wall as a reminder that in the world of U.S. financial compliance, experience isn’t obsolete. It’s essential.