My MIL Bragged, “Your Card Funded My $76K Vacation”—I Laughed Because It Wasn’t Even Mine

When my mother‑in‑law bragged, “Your card funded my seventy‑six‑thousand‑dollar vacation,” I just smiled—because that card wasn’t even mine.

My name is Raina Cooper. For the last four years I’ve been married to Evan—a smart, quiet software engineer, the kind of man who always tries to keep the peace. His mother, Lorraine Cooper, is the opposite: loud, proud, and convinced no woman will ever be good enough for her son. From the moment I joined their family, she made sure I never forgot it.

At first I thought she just needed time to warm up to me. But no matter what I did—help with dinner, bring thoughtful gifts, remember her birthday—it was never enough. She’d smile sweetly in front of Evan, then pull me aside and whisper, “You’ll never understand how this family works.”

Evan brushed it off. “That’s just Mom,” he said, as if that excused everything. I tried to believe him. I wanted peace. I wanted to fit in.

I work from our place outside Portland as an interior designer, managing small projects for local clients. Because Evan is often buried in code sprints, I handle our finances—bills, budgets, cards. I don’t mind. I’m careful with money, and we lived comfortably.

Lorraine had a habit that always made me uneasy. She’d call Evan out of the blue: “Can I borrow your card? It’s a family emergency.” Sometimes a few hundred for car repairs or co‑pays. Evan, being a good son, never said no. I didn’t like it, but I didn’t want another fight.

A few months ago, she mentioned a much‑needed Mediterranean cruise. She talked like it was a reward she deserved. I assumed she’d saved for it. Her socials filled with sunsets over the sea, flute glasses clinking, white‑tablecloth dinners.

When she came back, she couldn’t stop talking. One afternoon she stopped by wearing designer sunglasses and too‑shiny gold jewelry.

“Oh, Raina,” she laughed, dropping her handbag on our counter. “Your card funded my seventy‑six‑thousand‑dollar vacation. You really have expensive taste.”

Evan chuckled awkwardly. My stomach dropped. I excused myself, went to my desk, and opened our banking dashboard. There it was: a single charge—$76,243.18.

My hands shook. Lorraine had actually done it—and she was proud. I didn’t say a word. I closed the laptop, smiled tight, and watched her sip wine like nothing had happened. Inside, I promised myself: not this time.

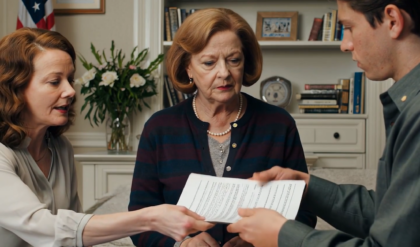

That night I waited until after dinner. “Evan,” I said calmly, showing him the statement, “your mom spent over $76,000. It’s right here.”

He barely glanced. “Yeah—Mom told me. She’ll pay it back.”

“Evan, that’s not a small amount. She didn’t ask. She took it.”

He shrugged. “You’re overreacting. She’s my mom. She wouldn’t steal from us.”

I swallowed the argument I knew I couldn’t win. “Okay,” I said quietly. Inside, I was boiling.

A few days later Lorraine arrived unannounced, dragging a shiny suitcase. Silk scarf. Gold earrings. A diamond bracelet that caught every light. “Souvenirs,” she sang. “You should’ve seen the resort—five stars. Worth every penny.”

“Lorraine,” I asked, “did you really use our card for your vacation?”

Her smile vanished. “Our card?” she snapped. “Excuse me—Evan offered to help. I didn’t steal anything.”

“I saw the charge,” I said. “You didn’t ask.”

“You should be grateful, Raina. Not everyone has family that helps out. You act like I owe you. You’re just jealous because I can afford nice things.”

Evan stepped in. “Rea, that’s enough. Mom said she’ll handle it.”

They stood there together, and a clear thought landed: they’d rather make me the villain than admit the truth. I smiled, excused myself, and went to the study.

I opened my files and started gathering everything—bank statements, card receipts, screenshots. If they wanted to treat me like a fool, I’d let them. For now.

At the kitchen table, I combed each line of the bank export. Hotel names, agency codes, transaction IDs. Then I saw a header for a card account that wasn’t in our names. It was linked to Lorraine—not to our joint card. The $76,000 charge showed under a secondary card issued to a business account I’d never opened or touched.

My stomach turned. Someone had routed a separate credit line through a company name. I kept digging. It got worse—other cards and loans tied to the same business profile. Some applications listed Evan as an authorized user. Others used my name on forms I’d never signed. The signatures were close, but wrong—tiny tells. Contact numbers I didn’t recognize. Addresses I’d never lived at.

I printed everything, labeled pages, and highlighted dates. Cold and steady—like I was cataloging a crime scene through glass. Someone had opened credit using our information. Not by accident.

That afternoon I went to our local branch and asked for fraud. I didn’t start with names. I explained the odd accounts and handed over the documents. The banker’s face changed. She asked precise questions, then said, “We’ll place holds and open an investigation. There are multiple suspicious applications.”

She confirmed some accounts used Evan’s SSN. Others listed me as a signer without authorization. They froze the riskiest lines that day, set bureau alerts, and handed me a letter confirming it.

I could have stormed home and given Lorraine a piece of my mind. Instead, I walked back slowly, carrying the file like something that could bite. I wouldn’t speak yet. Let them act normal. Let them brag. I began to plan—steps careful and exact.

By morning I called a lawyer I knew from college—Nate Barlo. His small downtown office smelled like coffee and paper. He read my folder silently, brow tightening. “Raina,” he said at last, “this isn’t a misunderstanding. Using your names, opening accounts, forging info—that’s identity theft and fraud.”

“What do I do?”

“Protect yourself first. Don’t tip them off. Move your money somewhere safe. If they realize you know, they may escalate.”

I opened a new account in my name only—no shared contact, no joint access. Over the next few days, I transferred modest amounts from savings—nothing flashy. I left the joint account open but almost empty, enough to look normal. Each transfer steadied me. This wasn’t greed. It was safety.

Meanwhile, Lorraine grew bolder—new outfits, more jewelry, chirping about her “next big trip.” At dinners she’d toast to her expensive taste and her son’s success. She’d glance at me, daring me to speak. I didn’t. I poured her more wine and took notes in my head.

When she started planning the Caribbean, I knew my chance had come.

A week later she called while I was reviewing a mood board. “Raina, dear—mind if I use the joint card for a few last‑minute things?” Her tone was breezy.

“Sure,” I said lightly.

She never checked balances. She always assumed there’d be more. That evening I called the bank’s fraud line. “Please monitor the joint card closely,” I said. “Don’t block—just observe. Notify authorities if anything flags.” The rep understood.

A few days later the attempts began: a luxury resort in Nassau, first‑class airline tickets, a premium car rental. Thousands in minutes. Then the messages I’d expected: declined, declined, declined. After repeated failures, the system froze the card and triggered an alert.

I pictured her at the check‑in counter, luggage stacked, a line behind her, that self‑satisfied smile fading.

Within the hour the fraud team called me. “Mrs. Cooper, the person using your joint account attempted several large purchases flagged as potential fraud. Authorities have been contacted.”

“Thank you,” I said.

Evan’s phone rang next. His mother had been stopped at the airport; the card was confiscated; her name was reported for suspected fraud. For the first time since this started, I felt peace. No gloating. Just quiet certainty: the trap had closed.

Evan grabbed his jacket and sped to the terminal. An hour later he called, voice shaking. “They’re saying Mom tried to use a card that isn’t hers. Police are looking at her accounts.”

I let out a soft gasp. “Oh no. I thought that was your card… Isn’t that what she told you?” Silence on his end.

Officers pulled records and linked multiple cards back to Lorraine’s applications. Forms showed forged authorizations—her handwriting imitating mine and Evan’s. When confronted, she laughed; then she panicked; then she blamed. “My son said I could. My daughter‑in‑law set me up.”

The paperwork said otherwise. Timestamps. IP addresses. Signatures. Transaction trails.

Evan called again later, voice small. “They found accounts in my name. And even one with yours. She signed your name.”

“I’m sorry,” I said gently. There was nothing else to add.

By evening, officers escorted Lorraine away for questioning. Her luxury bags sat abandoned near the ticket counter. When Evan came home he looked pale. I handed him water and said nothing.

Afterward he asked me to forgive her—“She didn’t mean harm.” I wanted to explain how his silence and enabling had cut me for years. But he framed himself as the victim. When I said I couldn’t forgive—not now—he accused me of “ruining his family.” The tension became a wall.

I packed quietly. I left a note on the kitchen table: You chose her long before I left.

Filing for divorce was hard—but necessary. I focused on my work, my independence, my peace. The house he thought he controlled no longer defined me. The family I’d allegedly “betrayed” was already my past.

When the case against Lorraine proceeded, I showed up with the same calm I’d carried for months. I presented facts: records, emails, reports. She tried to twist the story, to point fingers, to make me the villain—but evidence speaks for itself. Even Evan sat quietly now, watching reality land.

The day cuffs clicked around her wrists, I didn’t feel triumph. I felt closure. I’d stayed honest and let the system work. The court saw the truth.

Months later the divorce papers were final. I moved to a small coastal town in Oregon. The Pacific air smelled like a new page. I opened a tiny design studio on Main Street. Projects trickled in, then flowed. Each home I restored felt like a room in myself I was reclaiming.

One afternoon I opened a letter from Nate. Restitution from seized assets had been disbursed. The figure: $76,000.

I laughed softly—irony wrapped in peace. The amount she bragged about had come full circle.

I used it to launch a women’s financial‑literacy nonprofit—the Raina Project. Workshops. Mentors. A helpline for fraud and identity‑theft victims. A place to learn, plan, and protect.

Looking out at the Oregon surf from my office window, I thought of Lorraine’s words. “Your card funded my vacation.”

Turns out that same seventy‑six thousand helped build my freedom instead.

The waves kept moving—steady, unstoppable. So did I.